Other Ways to Give

Thank you in advance for your interest in supporting Fauquier Habitat for Humanity’s mission. We rely on various types of donations to improve individual lives and housing of our wonderful community.

- Explore non-cash giving options

- Corporate Donations

- House Sponsorship - Group Build

- Restore Sign Sponsorship

- Real Estate Donations

- Charitable Contributions

- In-kind Donations

Please contact our office for details on completing any of the above.

Corporate Donations

- If you have a controlling interest in the corporation and the property has been held for more than one year, the corporation can deduct up to ten percent (10.00%) of the net profit of the corporation.

- Excess contribution amounts can be carried forward up to five years. The fair market value here must be reduced by the amount of accumulate depreciation.

- If the corporation has elected “Sub-chapter S” status, then the contribution allowed will be reported on the individual shareholders K1 and may be deducted on the individual return.

- If your corporation offers "Matching Funds Program" to it's employees and you are willing to participate to support Fauquier Habitat for Humanity contact your Human Resources Organization for details and forms for matching funds.

House Sponsorship – Group Build Days

Your group or company can sponsor a home for a local family as Fauquier Habitat builds new homes and rehabilitates existing properties. Contact us to schedule a day to join us at a building site.

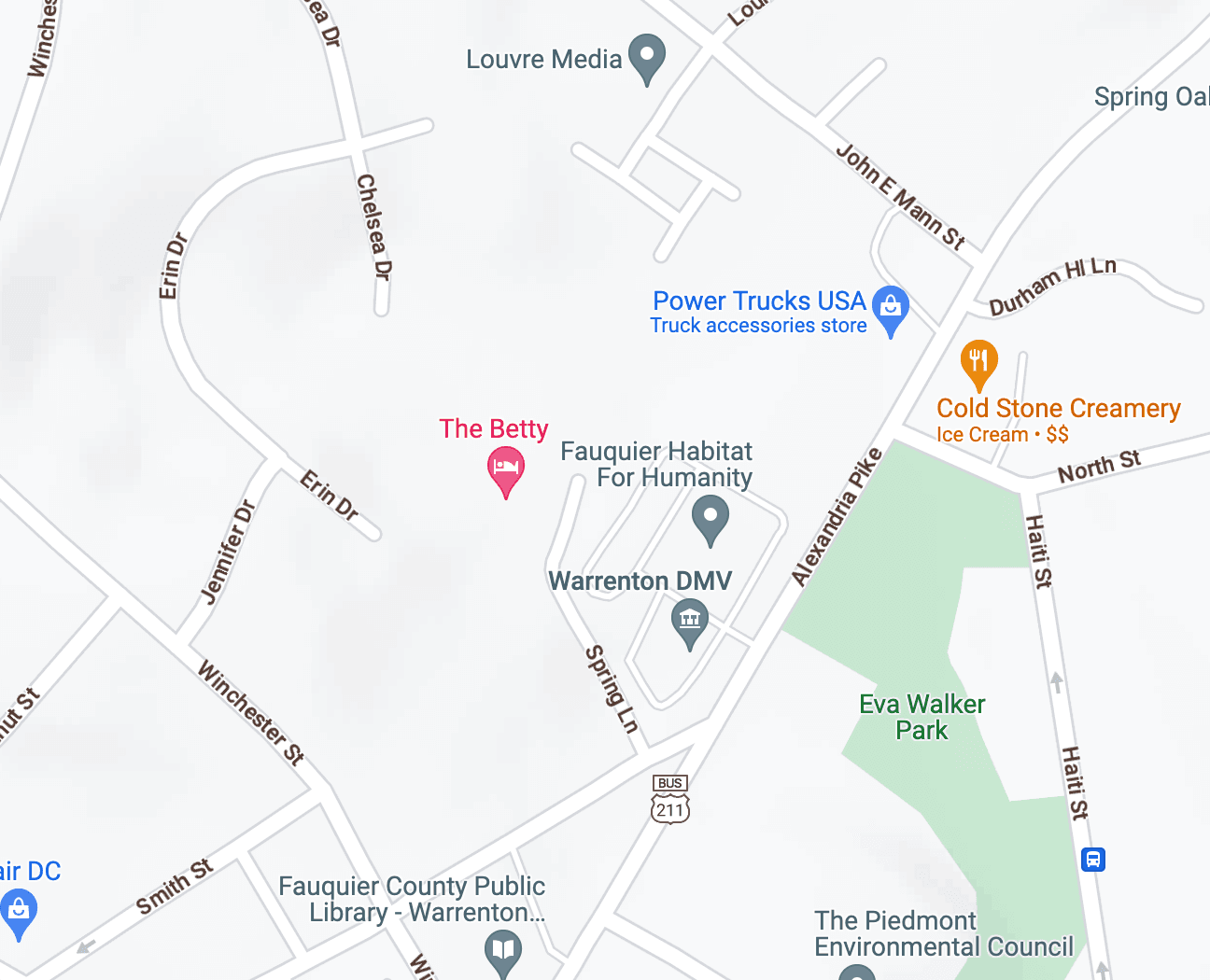

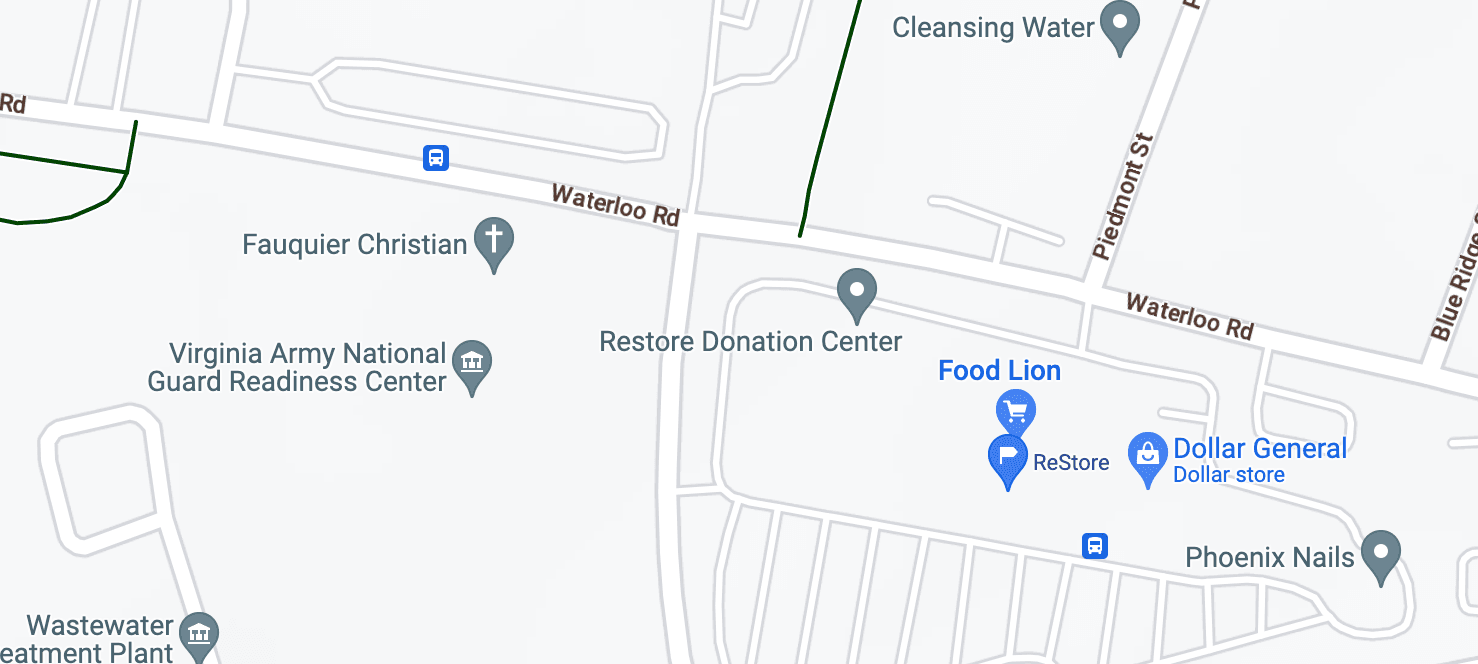

ReStore Sign or Van Sponsorship

A banner with your company logo will be displayed prominently in the Fauquier ReStore located in Warrenton. We limit sign sponsorships to one company per industry, so this is a great way to promote your company. Van sponsorship allows your logo to be displayed on the side of one of our work vans or hospitality trailer.

Real Estate Donations

Individuals – The following rules apply if the donated property is owned in your name, with your spouse or other persons:

- If you have held the property for more than one year, it is classified as long-term capital gain property. You can deduct the full fair market value of the donated property. Your charitable contribution deduction is limited to thirty percent (30%) of your adjusted gross income.

- Excess contribution value may be carried forward for up to five years. If the property has been depreciated, the fair market value must be reduced by its accumulated depreciation through the date of contribution. Fair market value is most commonly determined by an independent appraisal.

- If you elect to deduct your cost basis of the donated property, you are allowed a deduction of fifty percent (50%) of your adjusted gross income. Excesses here again can be carried forward up to five years. Which method you elect is dependent on the cost basis in the property donated, your tax bracket, the age and health of the donor and whether you plan to make future contributions.

- Please contact your financial advisor and/or tax consultant when starting this process.

Charitable Contributions

Your charitable contribution is truly appreciated as we require funds not only for building but for administrative purposes as well. Fauquier Habitat for Humanity is a tax-exempt 501(C)(3) nonprofit organization. Your gift is tax-deductible as allowed by law. You may want to contact your tax advisor before giving.

In-kind Donation

In-kind donation is a kind of charitable giving in which, instead of giving money to buy needed goods and services, the goods and services themselves are given. Gifts in kind are distinguished from gifts of cash or stock.

The generosity of architects, engineers, planners, contractors and suppliers helps reduce our building costs, which means lower mortgage payments for our first-time, lower-income home buyers.